This no-annual-fee card donates a portion of every purchase you make to support wetlands conservation.

If you like the idea of a card that rewards your great outdoors-related spending, consider a card like the Ducks Unlimited Credit Card.

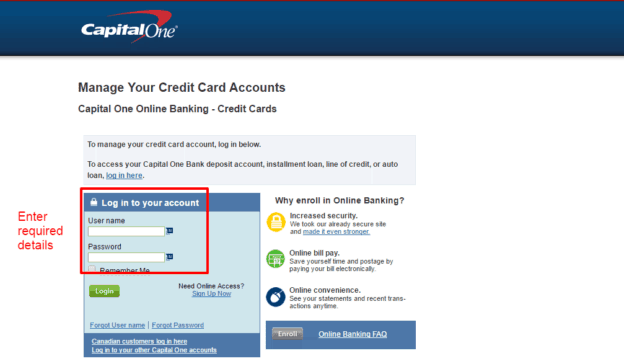

Capital one credit login pro#

Spending in other categories would net 30,564 points for a total of 41,790 points, which can be redeemed for $417.90 in qualifying purchases at Bass Pro Shops or Cabela’s.Ĭapital One Cabela’s CLUB® Credit Card * vs. Assuming that all of these purchases were made at Bass Pro Shops, Cabela’s or Cenex gas stations and earned 2 points per dollar spent, that would net 11,226 points. Of that $36,177 we estimate our sample cardholder would spend a combined $5,613 on leisure pursuits, clothing and gas spending. The 70th percentile of wage-earning households brings in $116,000 annually and has $36,177 in expenses that can be charged to a credit card. Rewards Potentialįorbes Advisor uses data from various government agencies in order to determine both baseline income and spending averages across various categories. Points can only be redeemed towards purchases with Cabela’s and Bass Pro Shops and its merchandising subsidiaries, including in-store restaurants, located in the U.S. Points are worth one cent each and there is no minimum redemption amount. Spend at least $25,000 on the card in a year and you’ll get the highest level status, Black, which will net you an oversized 5% back on your Cabela’s family spending. If you spend at least $10,000 on your Cabela’s credit card (on any purchases, not just at Cabela’s/Bass Pro Shops) in a calendar year, you’ll get boosted from Classic to Silver status which means you’ll earn a total of 3% back on your Cabela’s family spending. At the Classic level, you’ll earn 2% back at Bass Pro Shops, Cabela's & participating Cenex® locations and 1% back on all other purchases. For flexible rewards you can use any way you’d like, a general-purpose rewards card would be a more bountiful choice.Ĭardholders are automatically considered to be Cabela’s Club Classic Members. But most people eventually find they’ve acquired enough gear to fulfill the needs of their favorite pastime. If you plan to shop there for your entire life, that may not be an issue. This leaves you trapped in an endless cycle of earning rewards that can only be spent on more stuff within Cabela’s ecosystem. There’s no cash back and no applying your earnings towards a statement credit. That’s because, in addition to the rewards and APR structure, earnings on this card are only redeemable towards more merchandise from Cabela’s or Bass Pro Shops. These Cabela-centric terms mean it’s more like owning a store card, even though you could use it anywhere Mastercard is accepted.

If you tend to carry a balance, know that Cabela and/or Cenex spending will be subject to a lower APR than purchases made elsewhere with the card. Purchases made at participating Cenex convenience stores and gas pumps and Cabela’s or Bass Pro Shops will net you 2% back at Bass Pro Shops, Cabela's & participating Cenex® locations and 1% back on all other purchases. It may seem tempting to own the Capital One Cabela’s CLUB® Credit Card * if you’ve spent a decent amount of your disposable income at the outdoor specialty retailer.

0 kommentar(er)

0 kommentar(er)